Title: "Engaging in a Financial Conversation in English"

Introduction:

Engaging in financial conversations in English can be a valuable skill, especially when discussing topics such as personal finance, investment strategies, or financial planning. This article aims to provide an overview of key phrases, vocabulary, and tips to confidently navigate financial conversations in English.

1. Starting the Conversation:

When initiating a financial conversation in English, it is useful to begin with a polite and friendly introduction. Here are a few examples:

a) "Hi, I'm interested in discussing some strategies for financial planning. Can you offer any advice?"

b) "Hello, I'm looking to improve my investment portfolio. Could you please share some insights?"

2. Discussing Personal Finance:

When discussing personal finance matters, it is essential to use appropriate language and clarity. Here are some phrases and questions to help navigate this topic:

a) "How do you manage your personal finances effectively?"

b) "Do you have any tips for saving money and budgeting?"

c) "What are the best practices for debt management?

d) "What do you consider when choosing a credit card?"

3. Exploring Investment Opportunities:

When engaging in investment discussions, demonstrating knowledge and understanding is crucial. Here are some phrases and questions to facilitate such conversations:

a) "What investment options do you recommend for longterm growth?"

b) "Could you explain the concept of diversification and its benefits?"

c) "What is your opinion on stocks versus bonds as investment instruments?"

d) "How do you evaluate the potential risks and returns of different investment opportunities?"

4. Seeking Financial Advice:

If you are seeking advice from a financial professional, it is essential to ask relevant and specific questions. Here are some examples:

a) "Based on my financial goals, what investment strategies would you recommend?"

b) "How can I optimize my tax planning to minimize liabilities?"

c) "What are the regulatory considerations for investing in foreign markets?"

d) "What are the potential implications of specific government policies on my financial planning?"

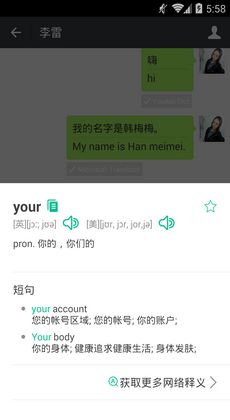

5. Understanding Financial Terminologies:

To have meaningful financial discussions, it is essential to understand and utilize relevant terminologies. Here are some common terms:

a) Assets: Anything of value owned by an individual or entity.

b) Liability: An obligation to repay debts or fulfill financial obligations.

c) Portfolio: A collection of investments owned by an individual or entity.

d) Return on Investment (ROI): The percentage gain or loss on an investment relative to the amount invested.

e) Compound Interest: Interest calculated on the initial amount invested as well as previously accumulated interest.

Tips for Successful Financial Conversations in English:

a) Prepare in advance: Familiarize yourself with financial terms and commonly discussed topics.

b) Listen actively: Pay close attention to understand the other person's points and ask clarifying questions when needed.

c) Be concise and clear: Use simple and straightforward language to articulate your thoughts.

d) Seek clarification: Do not hesitate to ask for further explanation of any unfamiliar concepts or terms.

e) Respect cultural differences: Be mindful of cultural nuances when discussing financial matters.

Conclusion:

Engaging in financial conversations in English requires a solid understanding of financial vocabulary and key phrases. By preparing, actively listening, and asking relevant questions, you can confidently navigate conversations about personal finance, investment strategies, and financial planning.

2024澳门六合彩今晚开奖结果,最新成语解释落实_网页版47.66...

澳门今晚开奖结果揭晓:最新成语解释“落实_3DM46.46.54”...

2024新奥开奖记录39期:真实性答案曝光落实_V版26.29.5...

2024年香港正版资料费大全,最新成语解释落实_VIP16.28....

2024新澳门资料大全:真实性答案曝光落实_app4.72.50...