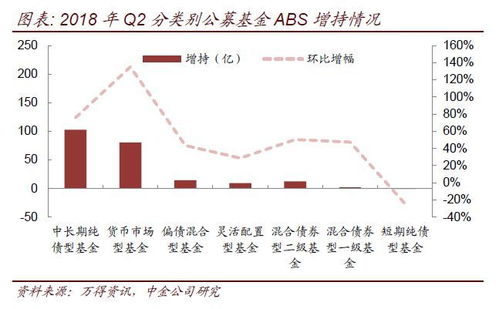

AssetBacked Securities (ABS) Investment Funds are financial vehicles that provide investors with exposure to a diversified pool of assetbacked securities. These funds play a crucial role in the financial markets, offering opportunities for diversification, risk management, and potential returns. Let's delve into the intricacies of ABS investment funds to understand how they work, their benefits, risks, and considerations for investors.

ABS Investment Funds pool money from various investors to invest in a portfolio of assetbacked securities. These securities are typically backed by assets such as mortgages, auto loans, credit card receivables, or other types of loans. The cash flows generated by these underlying assets, such as mortgage payments or loan repayments, provide income to the ABS investors.

ABS Investment Funds purchase assetbacked securities from issuers in the primary or secondary market. These securities are then held within the fund's portfolio. As underlying assets generate cash flows, such as interest and principal payments, they are passed through to the investors of the ABS fund.

While ABS Investment Funds offer various benefits, they also carry certain risks:

Before investing in ABS funds, investors should consider the following:

ABS Investment Funds offer investors exposure to a diversified pool of assetbacked securities, providing opportunities for income generation and risk management. However, it's essential for investors to assess the potential risks and conduct thorough due diligence before investing in ABS funds. By understanding the mechanics, benefits, and risks associated with ABS investment funds, investors can make informed decisions aligned with their financial objectives.

This guide aims to provide a comprehensive overview of ABS Investment Funds, covering their structure, workings, benefits, risks, and considerations for investors. Whether you're a novice investor exploring new opportunities or a seasoned professional looking to diversify your portfolio, understanding ABS Investment Funds is essential for making informed investment decisions.

2024澳门六合彩今晚开奖结果,最新成语解释落实_网页版47.66...

澳门今晚开奖结果揭晓:最新成语解释“落实_3DM46.46.54”...

2024新奥开奖记录39期:真实性答案曝光落实_V版26.29.5...

2024年香港正版资料费大全,最新成语解释落实_VIP16.28....

2024新澳门资料大全:真实性答案曝光落实_app4.72.50...